Market Update: Mortgage Rates Are Down a Full Percentage Point in One Year

Over the past 12 months, U.S. mortgage interest rates have declined by a full percentage point, offering a rare dose of good news for homebuyers and refinancers navigating a challenging housing market. According to data from Freddie Mac and other industry sources, the average 30-year fixed mortgage rate hovered above 7% earlier in 2025 but has since slid closer to the low 6% range: a meaningful drop that increases buying power and can significantly reduce monthly payments for homeowners locking in new loans or refinancing existing ones.

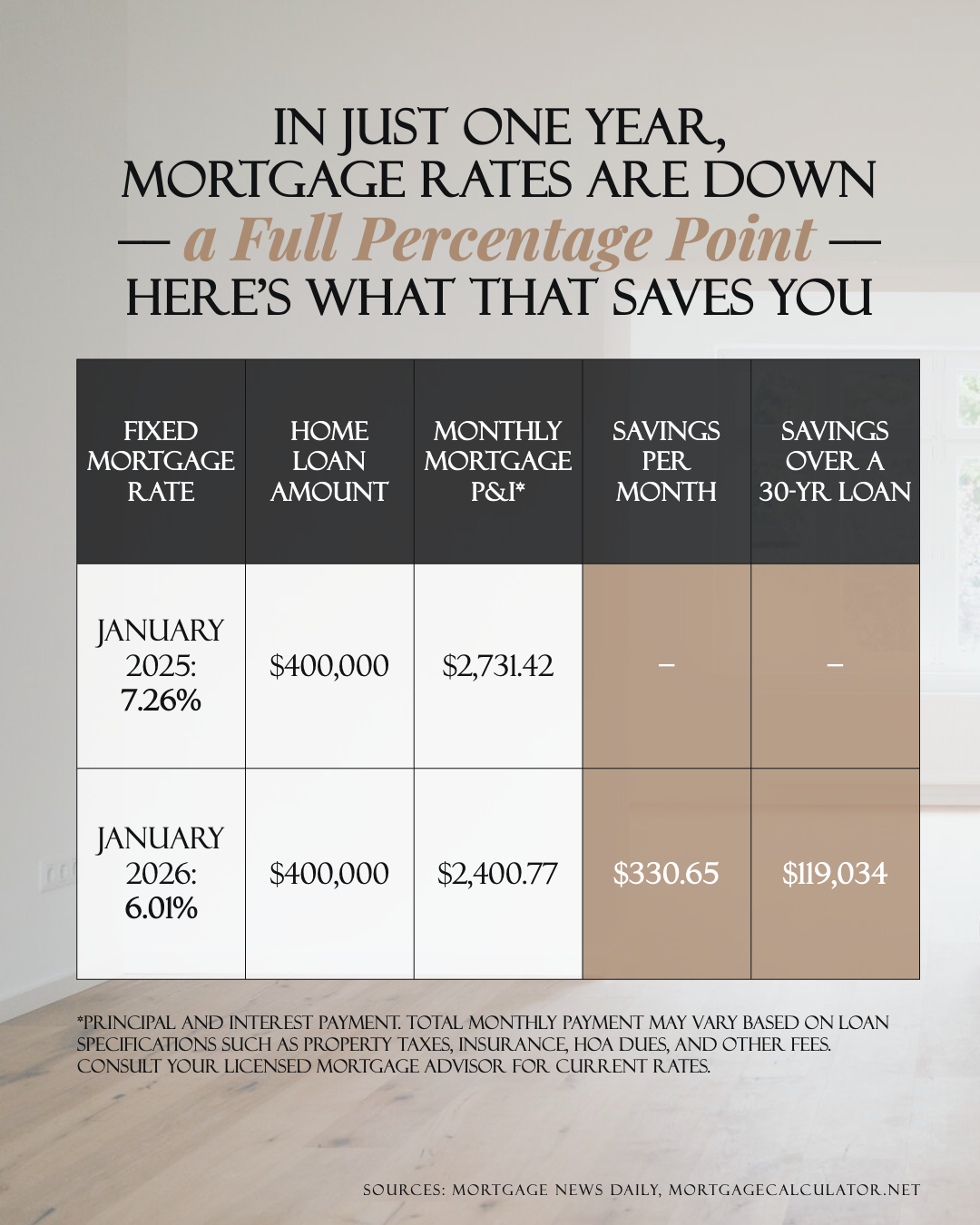

See the graph below to understand what that means:

This downward shift has helped reinvigorate refinance activity and given prospective buyers a bit more breathing room in a market that has seen affordability pressures for years. While economic factors such as Federal Reserve policy, Treasury yields, and broader financial conditions will continue to influence rate movements, the roughly one percentage point decrease from the year prior underscores an important trend: borrowing costs may be moderating, presenting an opportunity for both current and future homeowners to act strategically before conditions shift again.

That recent drop doesn’t sound dramatic, until you realize how much it can already save you on the typical $400k loan. Compared to buying in January of last year, that saves you more than $330 a month and almost $120k over the life of your loan.

That’s the difference just one year makes.

If buying didn’t work for you last year, let’s re-run the numbers and see if 2026 could finally be your year.

If you want help understanding what’s happening in our local market, curious about interest rates, or looking to buy or sell, let’s connect.