The 7 Step Process

to Buying a Home in Colorado

01

HOME BUYING Consultation

Meet with us (in person or virtually). We will review the home buying process with you and discuss your real estate goals including timing, wants, and needs. We will provide information on local neighborhoods, schools, market stats, and anything else you need to help determine your search area.

02

Pre-approval

If you need financing, the first step is to get pre-approved by a local lender. (We can refer you to some great ones!) You will submit financial information and work with your lender to determine your ideal budget.

03

Home Search

A thorough needs assessment will help us determine your search criteria and we will set up listing alerts for properties that meet your needs. We will tour homes until we find one that you love.

04

Make an Offer

We will craft a competitive offer based on market data and recent sales and negotiate on your behalf to get it accepted for the best price and terms. Once the contract is signed by all parties, an earnest money deposit will be due.

05

Home Inspection & Survey

We will review the property disclosures and coordinate a professional inspection of the entire property. If needed, we will obtain bids and negotiate for repairs or credits. We will also order and review a survey of the property lines if needed.

06

document review & appraisal

We will work with you to review the title commitment, due diligence documents, and HOA documents and address any issues that arise. Your lender will order an appraisal to verify the property’s value and finalize your loan commitment.

07

Closing & MOVING DAy!

You and your lender will review the final numbers. We will have a final walk through of the property and the closing papers are signed by all parties in front of a notary.

Pop the bubbly! Congratulations, on your new Colorado home.

Get ready to love where you live!

Buying a Home in Colorado

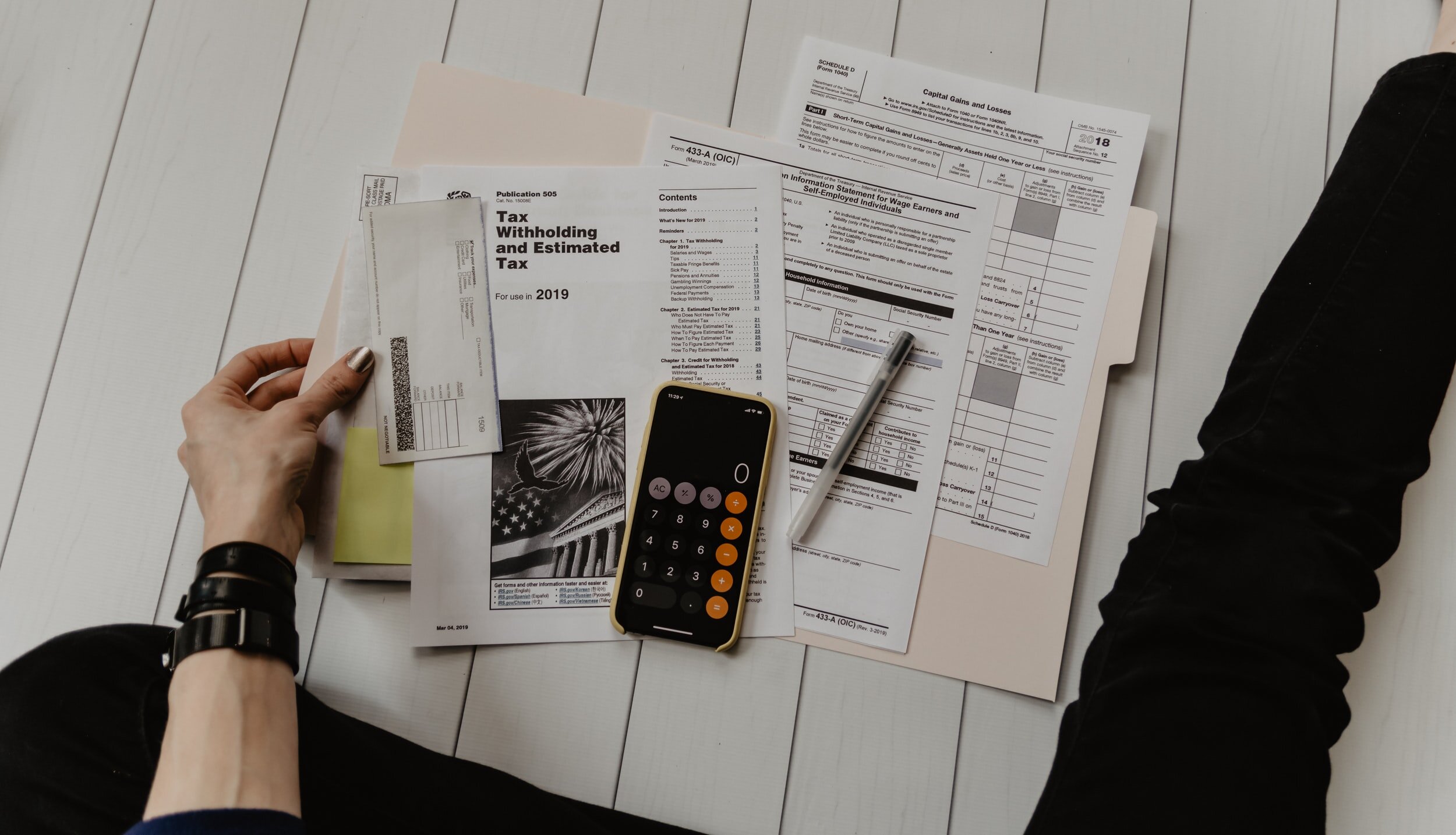

Financing Tips

✓

Get your credit in check

Buying and owning a home is a huge commitment. Make sure you’re financially prepared for homeownership. When you first speak with a lender, they will run an initial credit check and ask you questions like: What is your income? How much have you saved for a down payment? How much debt do you have? This will help determine how much house you can afford, and if there are steps you need to take to qualify for a mortgage. There are ways to improve your credit score if needed, such as paying bills on time, lowering outstanding debt, disputing any errors, and holding off on applying for any other loans or credit cards.

✓

Get organized

Your lender will need documentation from you in order to get you pre-approved for a mortgage loan. Here are few things to have ready for them:

- W-2 and 1099 forms from the past two years

- Pay stubs from the past 30 days

- Tax returns from the past two years

- Proof of other sources of income

- Two months of bank statements

- Details on long-term debts such as car or student loans

- ID and Social Security number

✓

find the right lender and get pre-approved

We always suggest you work with a local lender, who will be able to best help you navigate your purchase. This is especially important when buying in a competitive market. We can refer you to several lenders so you can interview them and choose the best fit for you. Your lender should be well-versed in the local market and run several loan scenarios to determine your options for mortgages and how you can get the best interest rate and terms. It is critical to obtain a full pre-approval before we start looking at homes.

Ready to love where you live?